Setvices Details

"IMPS Switching Services"

Home

IMPS Switching Services

BBPS Switching Services

- Bill payment is a major component of the retail payment transactions in India, and is characterized by the presence of large number of billers, who provide a variety of payment options to their customers. According to information available on the RBI website, the top 20 cities are generating INR 6,223 billion in bill payments every year – and over 70% of these transactions are still predominantly being carried out by cash or cheques. In addition, the present bill payment infrastructure in India is largely biller-specific in terms of modes of payment accepted and channels supported, and is still to support an ‘anytime, anywhere’ payment option to customers.

- These opportunities have been identified by various organizations that have aggregated various billers to provide a single platform to make all these payments. As the next logical step in the evolution of the bill payment ecosystem, there is a need for an integrated bill payment system in the country that offers interoperable and accessible bill payment services to customers through a network of agents, allows multiple payment modes and provides instant confirmation of payments.

- The objective of NPCI’s Bharat Bill Payment System (BBPS) is to implement an integrated bill payment system in the country that offers interoperable and accessible bill payment services to customers through a network of agents, enabling multiple payment modes, and providing instant confirmation of receipt of payment.

Customer benefits

- BBPS will offer the facility of “Anytime Anywhere” payment of bills, articipating on BBPS network, to customers through a network of agents.

- It is expected to provide an accessible bill payment system to the large segments of unbanked and under-banked population.

- Promotes financial inclusion since mobiles have good penetration in rural, semi-urban, and unbanked/underbanked populations.

- BBPS will provide interoperability so that consumers can pay the bills of any biller at a single point and facilitate payments via multiple modes i.e. Cash, Debit Cards, Credit Cards, Prepaid payment instruments including wallets and other electronic payment options such as Net banking, IMPS, NEFT, etc.

- The bill payment service points are expected to become ubiquitous, available to consumers near their place of work or residence.

- The BBPS outlets could include bank branches, business correspondents, Customer Service Points, retail agents of aggregators, ATMs (Automated Teller Machine), Kiosks, etc. Any customer will be able to pay bills of the billers enrolled in the BBPS system at any BBPS outlet.

- Furnishes instant confirmation of payment made via a payment receipt/ confirmation message. The receipt could be in the form of SMS/ email/ print out as desired by the customer

- The BBPS brand will assure trust and confidence amongst consumers for the certainty, reliability and safety of the transaction.

Benefits to participant bank

- IMPS Funds Transfer

- Will set up bill payment standards for the entire system and its participants in India.

- Will be an efficient and convenient medium for customers and other stakeholders.

- A number of value-added services relating to bills payments can be offered to consumers by the BBPOUs in course of time, subject to strict compliance with data privacy and security issues and standards. Will significantly reduce the systemic risks in collection and settlements.

- Has the potential to reduce the expenditure that billers incur on collection of bills at their own collection centres.

- Will lead to faster migration from assisted mode to self-service mode of payment and from cash payments to e-payment of bills.

- Potential to facilitate e-presentation of bills and quick e-payment of bills.

- Entry barriers for the small billers and billers with restricted geographic presence will be significantly reduced.

- Greater competition among the participants in the system which will benefit the consumers.

- BBPS system will have active fraud monitoring and risk mitigation system in place.

- An effective, efficient and centralized mechanism for handling customer complaints and grievances with committed SLAs for resolution.

- Advantages

- Capabilities

- Architecture

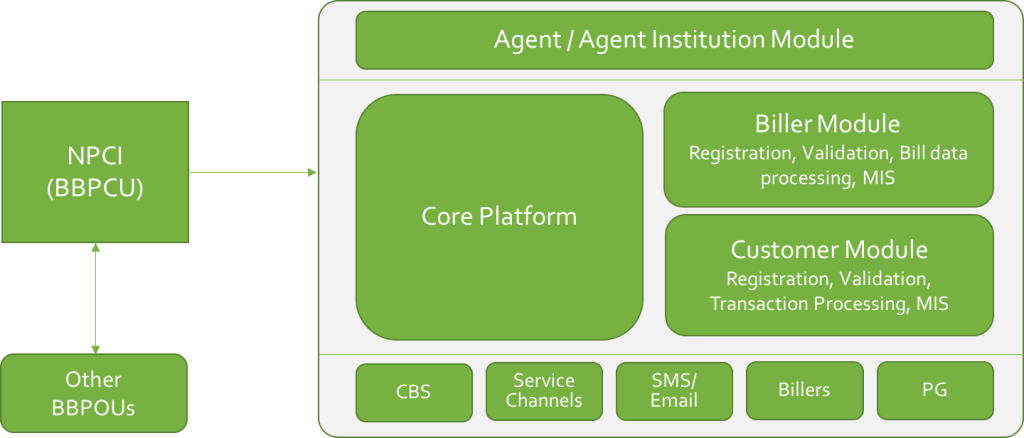

- Blazepe serves as the Agent Institution (Master Agent), enabling banks to seamlessly act as agents.

- Comprehensive Liquidity Management is provided for our agents, ensuring smooth operations.

- Supports both BBPS modules: Biller BBPOU and Customer BBPOU: Enabling Fetch Bill, Pay Bill, ON-US and OFF-US bill payments, ad-hoc payments, bill presentment, online bill payments, and offline collections.

- Centralized bill payment system for all delivery channels: Fully compatible with Mobile Applications, Net Banking, and Agent/Agent Web Portals, along with multiple integration methods.

- Agent/Institution Web Portal for efficient assisted bill payment services.

- Pre-built support for transaction limits, velocity rules, transaction fees, biller enrollment, and customer enrollment processes.

- Flexible online (message-based) and offline (file-based) interfaces for processing bill payments.

- Advanced payment risk management with transparency and real-time access to data.

- Seamless integration with legacy systems, payment networks, and proprietary technologies.

- Future-ready technology roadmap and strategies for payment migration.

- Supports both BBPS modules viz. Biller BBPOU and Customer BBPOU: Fetch Bill, Pay Bill, On-us and Off-us bill payments, Ad-hoc payments, bill payment and presentment, online bill payments and offline bill collections.

- Supports all delivery channels like Mobile Application, Net Banking and Agent / Agent institution Web-portals. Supports various methods for integration of channels, viz. ISO8583, XML over TCP/IP, HTTP(S) (Plain/XML/JSON/REST/Web Services), Host-to-host file transfer (for bulk uploads, etc.).

- Out-of-the-box support for :

- Transaction limits and Velocity rules

- Transaction fees

- Biller enrolment

- Customer enrolment

- Agent / Agent institution Web-portals